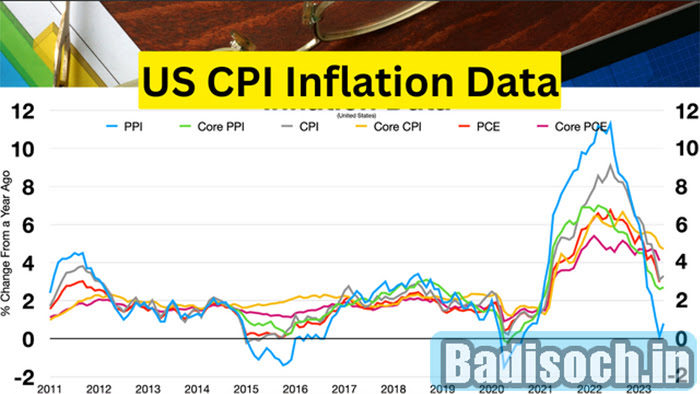

US CPI Inflation Data : In August 2023, the Consumer Price Index (CPI) in the United States increased by 3.7% year over year, surpassing the previous month’s 3.2% rise. The market expected a less significant increase of 3.6% to 306.976 points in the US CPI Inflation Data. Despite this increase, the US central bank decided to maintain interest rates at their present level after its meeting on September 19-20, 2023. As per CME’s FedWatch Tool, the market now predicts that the Fed will maintain rates at their present level for 97% of the time, up from 92% on Tuesday.

US CPI inflation data provides valuable insights into the overall price levels and inflation rate in the country. The Consumer Price Index (CPI) measures the average change in prices over time for a fixed basket of goods and services commonly purchased by households. By analyzing this data, economists and policymakers can assess the impact of price changes on consumers’ purchasing power and make informed decisions regarding monetary policy and economic stability. The CPI inflation data is crucial for monitoring price trends, estimating cost-of-living adjustments, and understanding the impact of inflation on various sectors of the economy.

US CPI Inflation Data

Energy costs were the main driver behind a significant portion of the increase, with a 5.6% rise on the month and a 10.6% increase in gasoline prices. Housing expenses, which make up almost one-third of the US CPI Inflation Data, saw a 0.3% increase, while food prices rose by 0.2%. Within the shelter category, the principal dwelling rent index grew by 0.5% and by 7.8% compared to the previous year. Owners’ equivalent rent also climbed by 0.4% and 7.3%, respectively, serving as an important indicator of homeowners’ rental expectations.

According to the survey, airfares have increased by 4.9% but are still 13.3% lower than they were a year ago. Despite this increase, it did not impact the decision of consumers. The cost of used cars, which is a significant contributor to US CPI inflation data growth in 2022 and 2023, decreased by 1.2% and is down 6.6% compared to last year. Transportation services had a monthly increase of 2%. These figures suggest that while some sectors are seeing an increase in prices, others are experiencing a decrease, resulting in an overall balance in the market. It will be interesting to see how this trend evolves over time and what impact it will have on the economy as a whole.

US CPI Inflation Data Details

| Article Name | US CPI Inflation Data |

| Category | News |

|

|

| Telegram | |

| Official Website | Click Here |

Also Check: Raksha Bandhan 2023

The meaning of US CPI Inflation

Inflation is a phenomenon that occurs when prices increase over time, leading to a decrease in the purchasing power of consumers. This means that you may not be able to afford the same goods and services as before, even if your income remains the same. Inflation can have serious consequences for those on a fixed budget or with limited financial resources, making it difficult to make ends meet. Additionally, inflation can lead to higher interest rates on loans and credit cards, further exacerbating financial difficulties. It is important to keep an eye on inflation rates and take steps to protect your finances from its negative effects.

The government calculates inflation by comparing the current prices of a range of products and services with their previous prices. In order to accurately reflect the increasing costs that consumers face, a diverse selection of items and services is used that represents the things people typically purchase. By comparing the same group of products and services over time, the government can gauge how prices are changing across the entire economy.

Check Here: Bigg Boss Season 17 Starting Date 2023

Main Factors Causing Current Inflation

Consumer demand is responsible for driving inflation.

- During the initial stages of the pandemic, individuals opted to remain in their homes. By doing so, they were able to reduce expenses associated with daycare and commuting. Additionally, changes in spending habits resulted in some individuals saving money. However, as circumstances have evolved, people are now venturing out more frequently and returning to their previous routines. This increased activity has subsequently led to a surge in demand for goods and services, consequently causing prices to rise.

The pandemic has also had an impact on the supply.

- The global lockdowns, factory closures, workforce shortages, and supply chain issues have resulted in a lag in product supply compared to demand. As a consequence, prices have risen across various sectors of the economy due to the insufficient supply in relation to demand.

There has been a noticeable change in consumer spending, as it has shifted from purchasing goods to investing in services.

- At the beginning of the outbreak, there was a lack of availability for most services. As things start to open up, people are increasing their spending on services and experiences. Activities such as traveling, dining out, and attending events have resumed. However, due to limited supply and rising labor costs, these prices have gone up.

Look Here: Chandrayaan 3 Wishes, Quotes

Protecting Yourself from Rising Inflation Rates

- Be sure you know your key expenses

- Be mindful of how and where you shop

- Check to see if your money is earning money for you

What’s the Government Doing to Help Inflation?

The objective of the government is to control inflation through financial regulations. In the United States, the Federal Reserve is responsible for managing financial regulations. In order to combat the increase in prices, the Federal Reserve has opted to raise interest rates. When the Federal Reserve increases rates, it affects short-term lending rates offered by banks. Consequently, individuals and businesses are required to pay higher interest rates when borrowing money from banks.

The increase in interest rates for vehicle loans, mortgages, and credit cards is likely to have a negative impact on economic activity. The rising cost of borrowing can lead to a reduction in borrowing and spending, which can affect both businesses and consumers. As a result, businesses may invest less while consumers may spend less, leading to a drop in demand. This decrease in demand can also reduce inflation levels as prices drop due to lower demand. It is therefore crucial for policymakers to carefully monitor interest rate changes and their impact on the economy to maintain stable economic growth.

Read More: Rapido Referral Code 2023

How Does Higher Inflation Affect You?

- Understanding inflation and government action is crucial. Understanding how inflation affects you is extremely crucial.

- Lower spending power is the primary consequence of inflation.

- When the costs of products and services increase, the value of money remains unchanged. However, this situation results in receiving less for the same amount of money. Consequently, effectively managing one’s daily expenses becomes challenging. Additionally, it may lead to a larger portion of one’s income being allocated towards important bills. As a result, there is a reduction in discretionary spending as well as savings and investment opportunities.

- Inflation has an impact on you by increasing the expenses associated with borrowing.

Conclusion

US CPI inflation data provides crucial insights into the state of the economy and the purchasing power of consumers. CPI, or Consumer Price Index, measures changes in the average price level of a basket of goods and services commonly purchased by households. By tracking CPI inflation, economists and policymakers can assess the impact of price changes on individuals’ cost of living and make informed decisions regarding monetary policy. Rising CPI inflation indicates that prices are increasing at a faster rate, potentially eroding consumers’ purchasing power. On the other hand, low or negative CPI inflation suggests that prices remain stable or are declining, which can benefit consumers.

US CPI Inflation Data FAQ’S

What is the CPI inflation rate in USA today?

US Inflation Rate is at 3.67%, compared to 3.18% last month and 8.26% last year.

What is the CPI for August 2023?

August saw a rise in the Consumer Price Index (CPI) inflation, with a rate of 0.6 percent. Over the past year, the inflation rate stood at 3.7 percent. These figures represent an increase compared to recent reports and were primarily driven by the surge in retail gasoline prices during August.

What time is the CPI report released today?

September 2023 CPI data are scheduled to be released on October 12, 2023, at 8:30 A.M. Eastern Time.

Is CPI higher than expected in August?

August core inflation, excluding food and energy, rose 0.3%, hotter than expected. The consumer price index rose 0.6% in August, its biggest monthly gain of 2023. The inflation gauge rose 3.7% from a year ago. The core CPI increased 0.3% and 4.3% respectively, against estimates for 0.2% and 4.3%.